Rework Station Hot Air Free Shipping

Rework Station Hot Air Free Shipping.

Brand; Dinghua.

Model: DH-A2E.

Split color vision system: CCD camera & LCD monitor.

Description/kawalan

Automatic Rework Station with Hot Air and Free Shipping

To find a rework station with hot air that suits your needs, you may want to consider factors such as the type

of work you will be doing, the temperature range you require, the types of nozzles that come with the station,

and the overall quality and reliability of the brand and model.

Model:DH-A2E

1.Product Features of Hot Air Automatic Rework Station Hot Air Free Shipping

•High successful rate of chip-level repairing. Desoldering, mounting and soldering process is automatic.

• Convenient alignment.

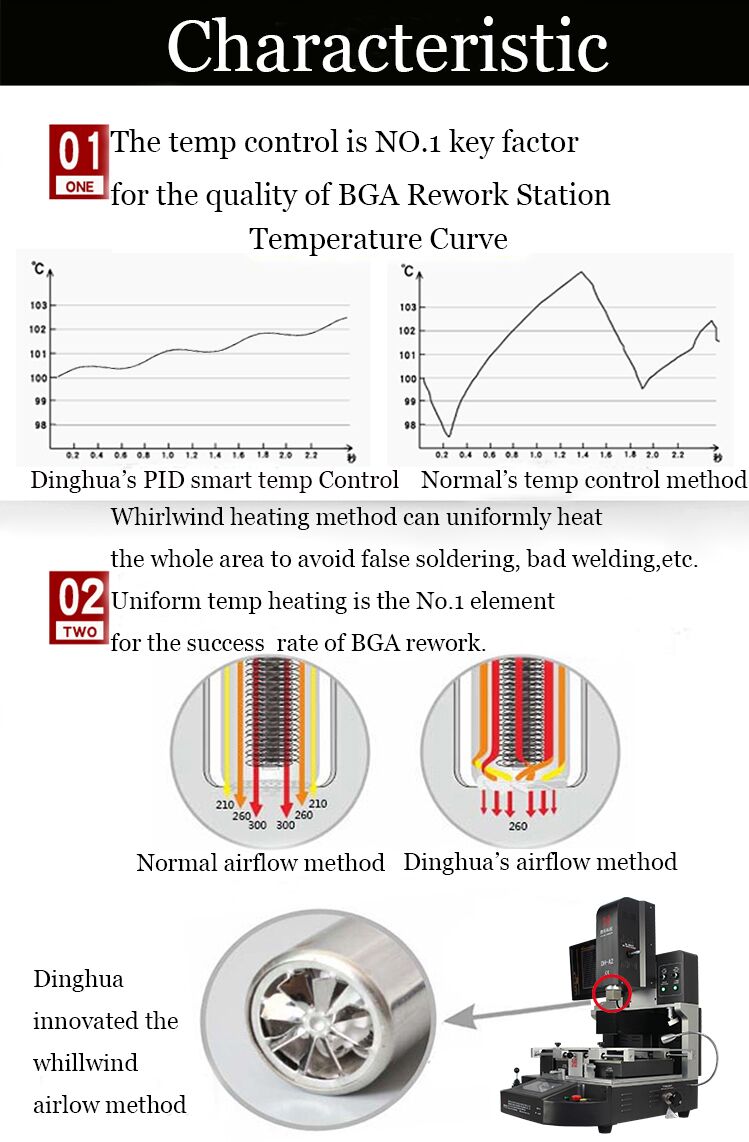

•Three independent temperature heatings + PID self-setting adjusted, temperature accuracy will be on ±1°C

•Built-in vacuum pump, pick up and place BGA chips.

•Automatic cooling functions.

2.Specification of Infrared Automated Rework Station Hot Air Free Shipping

3.Details of Laser positioning Automatic Rework Station Hot Air Free Shipping

Working video of rework station DH-A2E:

4.Why Choose Our laser position Automatic Rework Station Hot Air Free Shipping?

5.Certificate of Optical alignment automatic Rework Station Hot Air Free Shipping

6. Packing list of Optics align CCD Camera Rework Station Hot Air Free Shipping

7. Shipment of Automatic Rework Station Hot Air Free Shipping Split Vision

We ship the machine via DHL/TNT/UPS/FEDEX, which is fast and safe. If you prefer other terms of shipment,

please feel free to tell us.

8. Contact us for an instant reply and the best price.

Email: john@dh-kc.com

MOB/WhatsApp/Wechat: +86 15768114827

Click the link to add my WhatsApp:

https://api.whatsapp.com/send?phone=8615768114827

9.Related news about Automatic Rework Station Hot Air Free Shipping

Technology industry: semiconductor industry, on the verge of death

After the United States listed Huawei on the list of entities of the US Department of Commerce on May 17, 2019, the performance of China's

semiconductor-related shares outperformed other hardware stocks. Supply chain reshaping is expected to bring growth opportunities to local

semiconductor companies with strong R&D capabilities. With the launch of short-term internal science and technology, the investment sentiment

of semiconductor stocks (Hong Kong stocks and A-shares) is expected to be boosted.

At present, the market will focus on the design and manufacturing sectors, but upstream shares (especially in the material sector) will also gain

market attention. We update the major players in the industry chain and the Chinese market. As A-share listed companies make more acquisitions,

they will attract market attention to the industry. Compared with Hua Hong [1347.HK], we are still more optimistic about SMIC [0981.HK]. The

development of Shanghai Fudan [1385.HK] in FPGA has also attracted investors' interest.

China's semiconductor industry is expected to become the focus of the market After the Chinese government introduced policies to promote industry

development (especially directly participating in the National IC Industry Investment Fund), China's semiconductor sector has become an important

investment theme. However, due to weak downstream demand, global semiconductor stocks (including Hong Kong stocks and A-share companies)

suffered some selling pressure in 2018. After the US Department of Commerce put Huawei and 70 subsidiaries into the list of entities earlier this month,

the Chinese semiconductor sector once again became the focus of the market. There is no doubt that China's semiconductor stocks have lagged behind

their global peers, in part because of obstacles in accessing advanced technologies and processes, and this has had an impact on the supply chain. However,

the growing Sino-US trade situation is expected to lead China to reshape the global electronics supply chain. We believe that China is more determined to

establish a local supply chain, especially the semiconductor industry, and some Chinese and non-Chinese companies are moving out of China. Reshaping the

global supply chain will bring huge growth opportunities to local semiconductor companies. In view of the increased demand for semiconductor products and

low self-sufficiency, the Chinese government is actively promoting the development of the local semiconductor industry chain to reduce dependence on overseas

companies. We do not rule out that the Chinese government will introduce policies to promote the development of the local semiconductor industry. The National

Integrated Circuit Industry Investment Fund has been a major investor in Chinese semiconductor companies. It can be seen as a collaborative coordinator between

local semiconductor companies to help them move forward in difficult circumstances. In general, China's semiconductor industry can be divided into four categories: a)

upstream, mainly including materials and equipment; b) fabless and design companies; c) midstream companies, ie manufacturers, especially foundries ;d) Downstream

companies, mainly focused on packaging and testing.

Capital activities are expected to gain market attention

The semiconductor industry is a key focus as companies in the supply chain (raw materials, IC design, and foundry) have submitted IPO applications to the board. Among

them, Shanghai Silicon Industry Group (semiconductor materials), Qiqi Technology (IC design) and Hejian chip manufacturing (semiconductor foundry) all carry out large-

scale IPOs on the board. According to the latest news, the Science and Technology Board will initially evaluate the IPO of Anji Microelectronics in June 2019. We believe that

with the trading activities of the Science and Technology Board, it will bring opportunities for Hong Kong TMT shares (including semiconductor shares): a) release value through

spin-off; b) simultaneous listing of the two places; c) new valuation benchmark. The acquisition of Ziguang Guowei [002049.CH], Wentai Technology [600745.CH] and Vail Shares

[603501.CH] will attract market attention to the industry as they are acquired by leading companies in their respective industries.

It is expected that the foundry shares will continue to outperform in the short term.

As most Hong Kong-listed companies focus on manufacturing, wafer foundries (especially SMIC and Hua Hong) will remain the focus of investment in China's semiconductor

industry. Investors may be increasingly concerned about other semiconductor-related markets such as fabless, testing and packaging, so we provide up-to-date information on

industry value chains and key players in China. Relative to Hua Hong, we are still more optimistic about SMIC, because SMIC is moving to use more advanced technology to narrow

the gap with leading companies. The market is considering SMIC's N+1 technology as a technology that changes the industry landscape. Shanghai Fudan's move to develop FPGAs

has also attracted investors' attention because FPGAs are one of the market segments dominated by overseas companies such as Xilinx and Intel.

Related products:

surface mount components repair

Hot air reflow soldering machine

Motherboard repairing machine

SMD micro components solution

LED SMT rework soldering machine

IC replacement machine

BGA chip reballing machine

BGA reball

Soldering desoldering equipment

IC chip removal machine

BGA rework machine

Hot air solder machine

SMD rework station

IC remover device

Split color optical alignment system